|

The University of Michigan

555 South Forest Street

Third Floor

Ann Arbor, MI 48104-2531

T 734-936-9842

F 734-998-6341

/

|

|

|

No Bang for the Buck: Subsidizing Workers’ Premiums to Reduce Uninsured Rates

THE PROBLEM

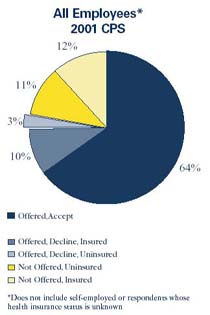

About one-quarter of the nation's 43 million people who lack health insurance live in a household in which someone declined to take coverage offered at work. On the surface, targeting those who currently are offered health insurance and subsidizing their premiums appears to be an easy way to increase rates of insurance coverage.

However, new research by MIT economists Jonathan Gruber and Ebonya Washington funded by the Economic Research Initiative on the Uninsured (ERIU) at the University of Michigan suggests that this seemingly simple solution would have a negligible effect on increasing insurance coverage, at a very high cost. Consistent with earlier research, they find that many of these employees turn down coverage even when their out-of-pocket costs are lowered. As a result, the main beneficiaries of the subsidy are workers already taking up insurance.

Gruber and Washington examined the effects of a federal policy change that allowed federal workers to pay their insurance premiums with pre-tax dollars, instead of post-tax dollars. Although not designed to increase coverage, the policy change not only failed to reduce significantly the number of uninsured federal workers, but it induced those already insured to move to more expensive health plans. The change resulted in 11,000 to 22,000 uninsured workers taking up health insurance, and it came at an average cost to the federal government of $38,000 per newly insured worker.

|

|

|

“Behind every seemingly straightforward solution lurk multiple unintended consequences. For policymakers seeking to cut the nation’s uninsured rate, the tension among participation, equity and efficiency is pervasive -- people lack health insurance for so many different reasons, and these reasons need to be carefully considered as we look for policy solutions.

While the popular notion of narrowly targeted subsidies may be more efficient than providing a subsidy to all workers, it raises concerns about fairness. Targeting subsidies penalizes those workers who opt to participate without a subsidy. Expanding public programs may raise fewer equity concerns but may also result in public dollars displacing private spending.

Research suggests that neither of these voluntary programs is the silver bullet leading to large increases in coverage. However, mandating participation raises its own concerns. While these types of tradeoffs are common in our current system, they are rarely recognized or debated. The devil really is in the details. Good policy can have unintended beneficiaries and unexpected costs, but the risks of making bad policy grow greater when all the consequences aren't considered.”

From Catherine McLaughlin, Ph.D., Professor at the University of Michigan and Director of ERIU |

THE FACTS

- The seductive solution. Recent declines in health insurance coverage rates are almost exclusively a result of reduced take-up of employer sponsored insurance (ESI) by workers. This trend makes the allure of premium subsidies attractive to policymakers seeking to extend coverage within the employer-based market.

- The truth behind this beguiling “fix.” While many uninsured individuals are offered ESI, the uninsured comprise only 7 percent of the total population offered such coverage. Targeting premiums would be an economically inefficient way to increase coverage, because those workers who already accept ESI offers – the overwhelming majority – would also be subsidized.

- The trick in targeting premium subsidies. More than 80 percent of workers who are offered ESI take it. Even the working poor tend to take up such offers – more than 75 percent of workers whose income falls below the poverty line take up ESI offers – making even subsidies targeted by income level costly relative to the gains.

- The unintended consequences of premium subsidies. While research studies show employee premium subsidies spur few decliners to change their minds, they do prompt employees who already take-up ESI to opt for more costly plans.

Q&A with Jonathan Gruber, Ph.D.

Jonathan Gruber, Professor of Economics at the Massachusetts Institute of Technology, has spent more than a decade examining health insurance issues. Gruber, former Deputy Assistant Secretary for Economic Policy at the U.S. Treasury Department, recently co-authored the paper, “Subsidies to Employee Health Insurance Premiums and the Health Insurance Market.”

Q-Do uninsured workers take up offers of employer-sponsored health insurance when the cost is lowered for them through subsidies?

A-Previous literature has found that generally people don’t change their minds. We examined the effect of the federal government’s introduction of tax subsidies for employer-provided health insurance to its employees. We looked at what happened to take-up rates among uninsured federal workers and found, very much in line with the previous literature, a close to zero effect on employees’ decisions to take up health care coverage when there’s a change in the subsidization of health care premiums.

Q-What was the effect of the subsidy – moving from a post-tax to pre-tax treatment of premiums -- for federal workers?

A-For a non-postal worker, the change took $500 to $1,000 off their health insurance costs.

Q-Your paper concludes that the subsidy increases government’s costs by about $700 million per year. And that led only 11,000 to 22,000 uninsured workers to take up coverage?

A-Right. About 7 percent to 8 percent of all federal employees are uninsured, and this change essentially made no dent in that number. To spend $38,000 per newly insured on such an incredibly small number is really the worst performance I’ve ever seen.

Q-What were those extra costs attributed to?

A-Essentially 99 percent of the effect of this policy was basically a tax break for federal workers who were already insured.

Q-Are there any cases where premium subsidies seem to be effective, like in SCHIP?

A-In terms of subsidies to those already offered health insurance, I see no context for their effective policy. But there are other types of subsidies that do work, such as offering subsidized buy-in rates to public insurance for low-income populations. I don’t want to tar all subsidies with one brush based on this research.

Q-What is the message to policymakers?

A-They should look at this in the context of the literature that exists. The bottom line is now you’ve got basically two different approaches to try to answer this question: one is to look casually at firms with different contribution rates; the other is to look more precisely at this particular change for a specific population. Both ways you end up with a similar answer: this is not a price responsive group. This is the final nail in the coffin of the argument that subsidizing premiums is an easy way to increase coverage.

For text of the full interview and paper, or a summary of findings, data, and methods, visit ERIU's website at www.umich.edu/eriu.

|

UPCOMING |

| This Research Highlight is the fourth in a series of research-based policy documents that will address current questions and issues related to the health care coverage debate. The next Research Highlight will examine how increases in the unemployment rate influence health insurance coverage rates. Research Highlights, conference proceedings and other materials can be found on ERIU’s website at . |

Click here for other ERIU Research Highlights

Click here for the full paper (Adobe PDF) Back to top

Funded by The Robert Wood Johnson Foundation, ERIU is a five-year program shedding new light on the causes and consequences of lack of coverage, and the crucial role that health insurance plays in shaping the U.S. labor market. The Foundation does not endorse the findings of this or other independent research projects.

|